News/Markets/Policy Updates: July 16, 2024

| Today’s Digital Newspaper |

MARKET FOCUS

• Powell: Fed won’t wait until inflation hits 2% to cut interest rates

• Fed will look for “greater confidence” that inflation will return to the 2% level

• Powell plans to serve out his full term, scheduled to end in 2026

• Japan may have injected around 2.14 trillion yen ($13.50 bil.) on Friday

• S&P 500 has surged over 18% this year

• S&P 500 up roughly 48% since President Biden’s inauguration day

• Macy’s terminated discussions with two investors

• Results of U.S. Retail Sales report for June 2024

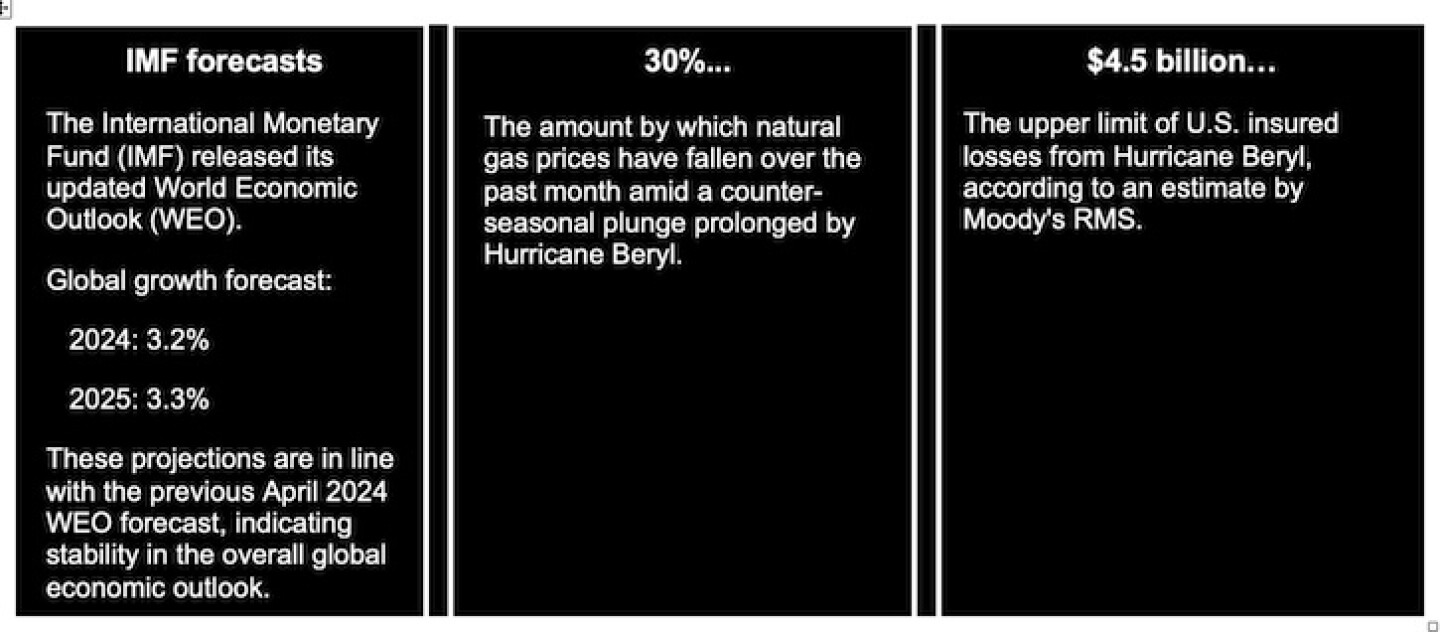

• IMF updates global economic forecasts

• Gold prices hit seven-week high overnight

• Freeport LNG restarting Texas natural gas export facility via phased basis

• World’s biggest buyer of copper purchasing more cheaper substitute aluminum

• Ag markets today

• Ag trade update

• NWS weather outlook

• Pro Farmer First Thing Today items

GOP NATIONAL CONVENTION

• Trump picks JD Vance as VP running mate

• Trump makes triumphant appearance at convention

• Highlights of first day at GOP National Convention

ISRAEL/HAMAS CONFLICT

• U.S. national security officials met with Israeli delegation White House on Monday

RUSSIA & UKRAINE

• Russian forces pushed into southern village of Urozhaine

• From July 1 to July 15, Ukraine exported a total of 2.3 MMT ag products

• Ukraine’s grain/oilseed production to fall more than 6%

• Ukraine’s summer crops face heat, moisture stress

POLICY

• Biden unveils rent cap plan

CHINA

• U.S. tariffs at 60% would halve China’s growth rate: UBS

• China’s manufacturing outpaces economy for third straight quarter

ENERGY & CLIMATE CHANGE

• General Motors tamps down expectations for electric-vehicle production

• Summit Carbon Solutions: laws override Iowa counties’ pipeline ordinances

• New EU rules require all new cars to be equipped with Intelligent Speed Assistance

LIVESTOCK, NUTRITION & FOOD INDUSTRY

• Investigation into human cases of bird flu (H5N1) in Colorado is ongoing

• Mo. AG will intervene in antitrust lawsuit against Tyson Foods

POLITICS & ELECTIONS

• Federal judge dismisses Trump classified documents criminal case

• Musk to commit $45 million a month to pro-Trump super political-action committee

• Highlights from President Biden’s interview with NBC’s Lester Holt

OTHER ITEMS OF NOTE

• Secret Service Director Kim Cheatle addresses Saturday’s shooting

• EPA announces new protections against pesticide spray drift

• Lawsuit challenges U.S. over conservation leases on public land

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed overnight. U.S. Dow opened up around 180 points and is currently up over 500 points. In Asia, Japan +0.2%. Hong Kong -1.6%. China +0.1%. India +0.1%. In Europe, at midday, London -0.3%. Paris -0.8%. Frankfurt -0.5%.

U.S. equities yesterday: The Dow rose 210.82 points, 0.53%, at a record close of 40,211.72. The S&P 500 increased 15.87 points, 0.28%, at 5,631.22. The Nasdaq rallied 74.12 points, 0.40%, at 18,472.57. Stock indexes pared some of their gains after Powell signaled that interest-rate cuts are coming but declined to say when.

— The S&P 500 has surged over 18% this year, driven by investor enthusiasm for artificial intelligence and optimism about potential Fed interest rate cuts. Analysts suggest that the possibility of Donald Trump’s return to the White House could further boost the market. This phenomenon, dubbed “the Trump trade,” implies expectations of lower taxes, deregulation, increased oil drilling, and more fiscal spending under Trump 2.0. Deutsche Bank strategist Jim Reid noted a clear shift in equities towards stocks that would benefit from Trump’s policies. Notable gains included crypto stocks, digital assets like Bitcoin, oil majors, and Trump Media, which rose more than 30%.

Of note: The S&P 500 is up roughly 48% since President Biden’s inauguration day, one of the best market runs of the past century.

— Macy’s terminated discussions with two investors that had offered to buy the company for about $6.9 billion, ending a monthslong bid to take the beleaguered department-store chain private. Macy’s said that after more than seven months of engagement with Arkhouse Management and Brigade Capital Management, it determined their latest proposal “fails to provide compelling value” to its shareholders.

— Ag markets today: Corn, soybeans and wheat recouped a portion of Monday’s sharp losses during the overnight session. As of 7:30 a.m. ET, corn and futures were trading 3 to 4 cents higher, while wheat futures were 1 to 4 cents higher. The U.S. dollar index was around 100 points higher and front-month crude oil futures were about $1.25 lower this morning.

Weaker cash cattle prices expected again this week. Cash cattle prices averaged $194.24 last week, down $2.85 from the previous week’s all-time high, though not as weak as early trade indicated. Cash sources expect prices to decline again this week as packers purchased a relatively large amount of cattle since the beginning of June given the current supply situation.

Pork cutout slips. The pork cutout slipped 55 cents on Monday as losses in butts and hams more than offset gains in the other cuts. Movement totaled 261.1 loads for the day. The CME lean hog index firmed 4 cents to $88.42 as of July 12. The new lead-month August contract finished Monday virtually in line with the cash index.

— Agriculture markets yesterday:

• Corn: December corn plunged 10 1/2 cents to $4.04 1/4, the lowest close since December 21, 2020.

• Soy complex: November soybean futures plunged 25 1/4 cents to $10.40 and closed near session lows. August meal futures skid $5.00 to $333.80. August bean oil futures fell 23 points to 46.42 cents though settled nearer session highs.

• Wheat: December SRW wheat fell 19 1/4 cents to $5.56 1/2. December HRW wheat dropped 14 1/4 cents to $5.72 1/4. Both markets closed nearer their session lows and hit contract lows. December spring wheat futures sunk 16 cents, closing at $6.01 1/4.

• Cotton: December cotton rose 117 points to 72.44 cents, a near two-week high close.

• Cattle: August live cattle fell 25 cents to $182.125 and nearer the session low. August feeder cattle closed up $0.125 at $258.775 and near mid-range.

• Hogs: August lean hog futures closed 2.5 cents lower to $88.425 and settled near mid-range. July futures went off the board 5 cents lower at $88.65.

— Quotes of note:

• Fed Chair Powell discusses economic outlook but stays neutral on rate cuts. Federal Reserve Chair Jerome Powell stated that inflation and economic activity have slowed as expected but did not indicate whether this would lead to lower interest rates at the upcoming policymakers’ meeting. During a Q&A session in Washington DC, Powell emphasized a “meeting by meeting” approach to decision-making, avoiding any specific signals about future rate changes. Recent data shows inflation easing and labor-market conditions cooling, which may support rate cuts to avoid unnecessary economic weakness. The Fed raised rates to their highest level in over two decades last July to combat high prices. Investors anticipate rate cuts starting in September. Fed officials face a dilemma: reducing rates too slowly could harm hiring, while cutting too soon could prevent inflation from reaching the Fed’s target. Economic projections suggest rate cuts are likely this year if inflation slows and growth remains moderate. Powell’s comments at the Economic Club of Washington, D.C., were notable as they followed a positive June inflation report and preceded the Fed’s pre-meeting quiet period. Investors were looking for hints about rate cuts in September, but Powell maintained a steady stance, aligning with expectations that the Fed will keep rates unchanged at the July 30-31 meeting.

• Powell said he plans to serve out his full term, which is scheduled to end in 2026.

• “The Chinese economy is foundering.” — Eswar Prasad, professor of trade policy at Cornell University and former head of the International Monetary Fund’s China division.

• “A French wealth tax would increase French export of good entrepreneurs to Silicon Valley! Please go for it!” — Vinod Khosla, the venture capitalist, taking a swipe at speculation that French politicians will reinstate a wealth tax as part of negotiations to form a governing coalition in Parliament.

— Results of U.S. Retail Sales report for June 2024:

• Total retail and food services sales were $704.3 billion, virtually unchanged from the previous month, following an upwardly revised 0.3% rise in the previous and matching market forecasts.

• Sales increased by 2.3% compared to June 2023.

• For the April-June 2024 quarter, total sales were up 2.5% from the same period a year ago.

• Retail trade sales specifically decreased 0.1% from May 2024, but were up 2.0% from last year.

• Nonstore retailers (e.g. e-commerce) saw an 8.9% increase compared to June 2023.

• Food services and drinking places experienced a 4.4% increase from June 2023.

• Sales at gasoline stations were down 3% and those for autos declined 2.3%.

Bottom line: The report indicates relatively flat month-over-month growth but continued year-over-year increases, suggesting steady but modest consumer spending. The strong performance of nonstore retailers highlights the ongoing shift towards online shopping. While overall sales remain positive compared to last year, the lack of significant monthly growth may indicate some cooling in consumer sentiment.

— The International Monetary Fund (IMF) updated its global economic forecasts, highlighting several key points:

Global Growth Projections:

The IMF forecasts global growth to remain steady at 3.2% for both 2024 and 2025, consistent with the growth rate in 2023. This marks a slight upgrade from earlier predictions.

Despite this steady growth, the five-year forecast for global growth stands at 3.1%, the lowest in decades, reflecting long-term challenges.

Regional Growth Variations:

Advanced economies are expected to see a slight acceleration in growth, from 1.6% in 2023 to 1.7% in 2024 and 1.8% in 2025.

Emerging market and developing economies are projected to experience a modest slowdown, with growth declining from 4.3% in 2023 to 4.2% in 2024 and 2025.

Inflation Trends:

Global inflation is forecast to decline from 6.8% in 2023 to 5.9% in 2024 and further to 4.5% in 2025. Advanced economies are expected to reach their inflation targets sooner than emerging markets.

Core inflation is projected to decline more gradually, indicating persistent underlying price pressures.

Economic Resilience:

The global economy has shown surprising resilience despite significant central bank interest rate hikes aimed at restoring price stability. This resilience is partly attributed to changes in mortgage and housing markets that have moderated the impact of higher policy rates.

Medium-Term Challenges:

The IMF highlights persistent structural frictions that prevent capital and labor from moving to more productive firms as a key factor behind the lower predicted growth in output per person.

Dimmer growth prospects in China and other large emerging market economies are expected to weigh on their trading partners, posing a risk to global trade.

Policy Recommendations:

The IMF emphasizes the need for central banks to ensure a smooth decline in inflation, avoiding premature policy easing or excessive delays that could lead to target undershoots.

A renewed focus on fiscal consolidation is recommended to rebuild budgetary maneuverability, prioritize investments, and ensure debt sustainability

Market perspectives:

— Outside markets: The U.S. dollar index was firmer. even as the euro, yen and British pound were all higher against the dollar. The yield on the 10-year U.S. Treasury note was lower, trading around 4.17%, with a negative tone in global government bond yields. Crude oil futures moved lower, with U.S. crude around $80.35 per barrel and Brent around $83.40 per barrel. Gold and silver futures were higher ahead of U.S. economic data, with gold around $2,445 per troy ounce and silver around $31.08 per troy ounce.

— Gold prices hit a seven-week high overnight on ideas of U.S. interest rate cuts coming soon. A DowJones Newswires headline today reads: “Gold futures rise as banks bet on two U.S. interest rate cuts.”

— Data suggests additional Japanese yen intervention. Japan may have spent an additional 2.14 trillion yen ($13.50 billion) on Friday in the foreign exchange market as it intervened to shore up the yen late last week, Bank of Japan (BOJ) data suggested. The central bank’s projection for Wednesday’s money market conditions indicated a 2.74 trillion yen net receipt of funds, compared with a 600 billion yen net receipt estimate from money market brokerages, that excludes intervention. The suggests the ministry of finance could have spent around 2.14 trillion yen intervening in the market last Friday. That would be on top of the 3.37 trillion to 3.57 trillion yen it is estimated to have spent last Thursday.

— Freeport LNG is restarting its Texas natural gas export facility on a phased basis after Hurricane Beryl damaged part of the plant. The company plans to restart its first production line this week, with the intent to start the remaining units shortly thereafter, spokeswoman Heather Browne told Bloomberg. Still, output is expected to be at reduced rates, she said, without saying how long the reduction would last. The plant is designed to produce 15 million metric tons of LNG annually.

— World’s biggest buyer of copper, State Grid Corp. of China, has been purchasing less of that metal and more of cheaper substitute aluminum. A sustained shift could rock the global market, says a Bloomberg article (link).

— Ag trade update: Japan is seeking 115,208 MT of milling wheat in its weekly tender. Egypt tendered to buy an unspecified amount of wheat from multiple origins. Thailand tendered to buy 175,200 MT of optional origin feed wheat.

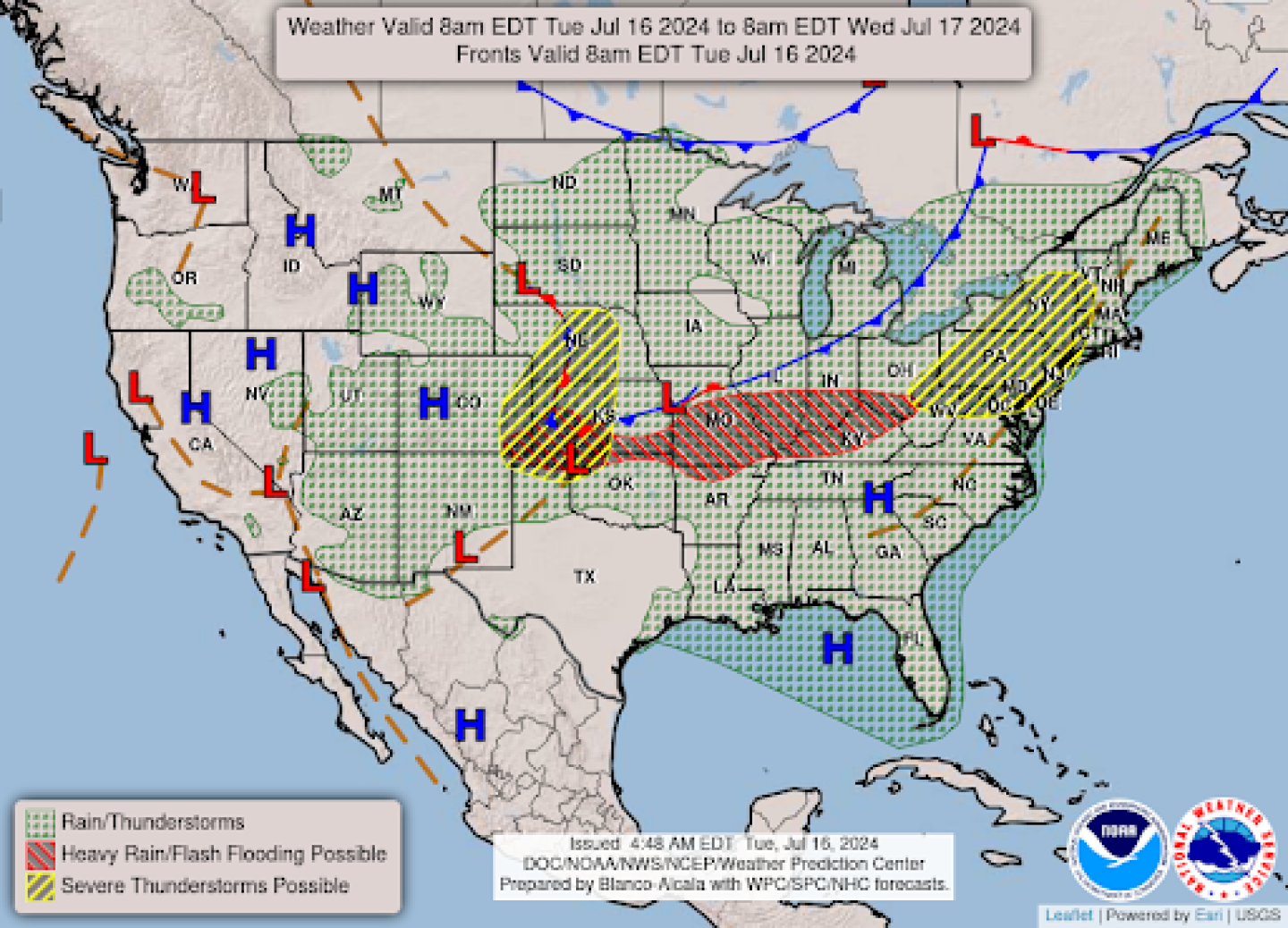

— NWS weather outlook: There is a Slight Risk of severe thunderstorms over parts of the Central/Southern Plains and Northeast/Mid-Atlantic/Central Appalachians on Tuesday and the Mid-Atlantic to New England on Wednesday... ...There is a Slight Risk of excessive rainfall over parts of the Central/Southern High Plains roughly eastward to the Ohio Valley on Tuesday and the Southern Rockies, Lower Mississippi Valley, and Central Appalachians on Wednesday... ...There are Excessive Heat Warnings/Watches and Heat Advisories over parts of the Pacific Northwest and parts of the Southern Plains to the Middle/Lower Mississippi Valley, Ohio/Tennessee Valleys, and Central Gulf Coast.

Items in Pro Farmer’s First Thing Today include:

• Mild corrective buying in grains overnight

• Corn and soybean CCI ratings slip, spring wheat improves

• Crop Progress Report highlights

• Cordonnier raises U.S. corn yield, production forecasts

| GOP NATIONAL CONVENTION |

— Trump selected Ohio Senator JD Vance as his vice-presidential running mate for the 2024 election. He won the Republican Senate primary in 2022 with just 32% of the vote, and probably only by the margin of Trump’s endorsement, says election analyst Nate Cohn. “The 2022 general election didn’t go much more smoothly. He won by only six percentage points, a worse tally than Mr. Trump’s eight-point victory in 2020 and the combined 13-point victory for Ohio’s Republican congressional candidates on the same ballot on the same day. In each election, he fared poorly in the highly educated suburbs where one might have assumed that a young Yale-educated lawyer and best-selling author would play well. In the general election, he ran well behind Mr. Trump in Appalachia.” Link to our special report on the topic.

Since his successful 2022 Senate run with support from Trump, Vance has positioned himself as a new-age populist conservative willing to challenge big business. He has introduced various legislation targeting the financial services industry, including a proposal with Senator Elizabeth Warren (D-Mass.) to penalize executives of failed banks after the collapse of Silicon Valley Bank. Additionally, Vance has praised President Biden’s FTC Chair Lina Khan for her aggressive antitrust actions.

Recently, Vance has entered the debate on cryptocurrency regulation on Capitol Hill, working on an industry-friendly crypto bill that has garnered support from digital asset enthusiasts. While he aligns with his party on key financial regulation issues, such as opposing increased capital requirements on large banks, Vance insists that the GOP’s lighter-touch regulation should not come without conditions.

In a Senate hearing last year, Vance challenged bank CEOs, questioning why Republicans should support financial institutions that use their power against the values of GOP voters and harm constituents reliant on cheap energy. He emphasized the need for a balanced relationship, warning that the more banks involve themselves in political fights, the less favorable their relationship with Republicans will be.

Vance is pro labor. The New York Times Andrew Ross Sorkin says the postwar economy has relied too heavily on cheaper labor, a tactic that undercuts wages for American workers and has been exploited by big business. He’s argued that employers’ zeal for cheap labor has helped lead to a surge in unauthorized immigration to the U.S. and that consumers have become addicted to products made in low-wage countries. Those factors have aggravated America’s foreign trade deficit and hit domestic manufacturing, he’s said.

Several Pro Farmer members have asked about Vance’s position on biofuels. We can infer some alignment between Vance and Trump’s policies on biofuels based on the following points:

• Vance has become a strong supporter of Trump’s policies since aligning himself with the former president. He has shifted his views on various issues to match Trump’s positions.

• Trump has been supportive of ethanol and biofuels, particularly in relation to the agricultural sector. In 2018, Trump ordered the Environmental Protection Agency to expand sales of corn ethanol, which was seen as a gift to farm states and corn producers.

• Trump’s directive aimed to increase the availability of E15 gasoline (containing 15% ethanol) year-round, which was a significant move to support corn growers and the ethanol industry.

• Vance has positioned himself as pro-Trump and supportive of policies that benefit domestic industries. As a senator from Ohio, an agricultural state, he is likely to be attentive to policies that support farmers.

• Vance has been critical of Biden administration policies related to energy, including the Inflation Reduction Act, which he claims has made the economy less energy independent. This suggests he may favor policies that support domestic energy production, potentially including biofuels.

• While we can find no explicit statements from Vance on ethanol and biodiesel, his alignment with Trump’s policies and his representation of an agricultural state suggest he may support similar pro-biofuel stances. However, it’s important to note that Vance has also been supportive of the oil and gas industry, which could potentially conflict with strong support for biofuels.

The Associated Press reports (link) that Vance became involved with AppHarvest, a high-tech indoor farming company in Appalachia, in 2020. His venture capital firm, Narya Capital, invested in the company, and Vance briefly served on AppHarvest’s board of directors. AppHarvest was initially hailed as a promising venture, aiming to revolutionize agriculture in Appalachia using advanced indoor farming techniques. The company’s mission aligned with Vance’s narrative of returning to his roots to help revitalize the economically challenged region. However, AppHarvest soon faced significant challenges. Between November 2021 and August 2022, the company became embroiled in five lawsuits filed by investors and a county retirement association. These legal actions alleged that AppHarvest had misled regulators and investors by inflating its hiring and retention numbers in SEC filings and public statements. The company struggled with high operational costs and lower than expected crop yields. These issues, combined with economic uncertainty during the pandemic, made it difficult for AppHarvest to raise additional capital. On July 26, 2023, AppHarvest filed for Chapter 11 bankruptcy. The filing came because of the company’s inability to overcome its financial challenges and operational setbacks. While Vance was not directly implicated in the lawsuits and had left AppHarvest’s board in April 2021 before his Senate bid, his association with the company drew scrutiny. Critics questioned the effectiveness of his efforts to uplift the Appalachian region through ventures like AppHarvest. Despite these setbacks, Vance’s campaign has emphasized that his investment firm, Narya Capital, remains supportive of AppHarvest and its potential to transform American food production

Bottom line, according to Cohn: “He’s a self-described nationalist who is well positioned to carry the MAGA torch on trade, foreign policy, entitlements and immigration, even after Mr. Trump is no longer running for president.”

— Donald Trump made a triumphant appearance at the Republican National Convention in Milwaukee on Monday, July 15, 2024, marking his first major public appearance since surviving an assassination attempt just two days earlier. The former president entered the convention hall with a white bandage covering his right ear, a visible reminder of the recent attack

Trump’s entrance was met with a raucous ovation from the delegates and attendees. He appeared visibly emotional as he emerged in the arena to the sound of Lee Greenwood singing “God Bless the USA.” Despite the recent attempt on his life, Trump smiled and waved to the crowd, though his reactions were notably more subdued than usual.

The convention had earlier formally nominated Trump as the Republican presidential candidate for the 2024 election. His appearance at the event was not for a speech —that is scheduled for Thursday — but rather to acknowledge his nomination and show resilience in the face of the recent attack.

Trump’s presence at the convention, despite the recent attempt on his life, was seen as a powerful statement of his determination and resilience. It also underscored the strong support he continues to enjoy within the Republican Party, with many speakers at the convention expressing their backing for the former president.

— First day of the 2024 Republican National Convention in Milwaukee featured several key highlights:

• Donald Trump’s appearance: Trump made his first public appearance since the recent assassination attempt at a Pennsylvania rally. He was seen with a bandage covering his ear, drawing attention to the recent incident.

• Vice presidential announcement: Trump announced Ohio’s Republican Senator JD Vance as his 2024 running mate. This decision was reportedly influenced by Trump’s sons, who advocated strongly for Vance.

• Economic focus: The night’s theme was “Make America Wealthy Again,” with most speakers addressing economic issues and criticizing the perceived lackluster economy under President Joe Biden’s administration.

• Unity and division: While there was an emphasis on Republican unity in the wake of the assassination attempt, some speakers still engaged in divisive rhetoric targeting Democrats and other groups.

• Patriotic performance: Lee Greenwood performed “God Bless the U.S.A.,” a staple at Trump rallies, which evoked emotional reactions from many attendees, including Donald Trump Jr.

• Addressing the recent incident: The aftermath of the assassination attempt was subtly addressed by selected speakers, balancing the need to acknowledge the event without overshadowing the convention’s main messages.

• Teamsters President Sean O’Brien’s speech: This was a standout moment, as O’Brien became the first Teamster in the union’s 121-year history to address a Republican National Convention. While not endorsing Trump, he praised the former president’s willingness to engage with new and often critical voices

• Convention venue: The event took place at Fiserv Forum, where an electrifying atmosphere was seen and felt.

Quote of note: From the NYT’s David Brooks on Sean O’Brien, the president of the Teamsters, who was given a prime slot. “The (partial) pro-union shift among senators like Josh Hawley and JD Vance is real. Watching somebody attack the ‘corporatists’ from the stage of the Republican convention is like watching the tectonic plates (partially) shift.”

| ISRAEL/HAMAS CONFLICT |

— U.S. national security officials met with an Israeli delegation at the White House on Monday to discuss the threat posed by Iran to Israel. The talks involved US National Security Adviser Jake Sullivan, Secretary of State Antony Blinken, Israeli National Security Adviser Tzachi Hanegbi, Minister of Strategic Affairs Ron Dermer, and other senior Israeli officials. During the discussions, Israeli officials expressed their support for the Biden administration’s proposed ceasefire and hostage release deal, which has also received backing from the UN Security Council.

| RUSSIA/UKRAINE |

— Russian forces pushed into the southern village of Urozhaine, the latest of several slow but steady advances.

— From July 1 to July 15, Ukraine exported a total of 2.3 million metric tons (MMT) of agricultural products. This included:

• 777,000 metric tons of corn

• 767,249 metric tons of wheat

• 288,613 metric tons of barley

• 207,632 metric tons of sunflower oil

For comparison, the total agricultural exports for June amounted to 5 MMT. During the first half of July, approximately 2 MMT of exports were shipped through Ukraine’s Black Sea ports, while another 217,000 metric tons were transported via road or rail.

— Ukraine’s grain/oilseed production to fall more than 6%. Ukraine’s combined grain and oilseed production could fall to 77 MMT from around 82 MMT in 2023, the county’s major agricultural producers group Ukrainian Agrarian Council (UAC) said. Despite the production decline, a UAC official said the 2024-25 exportable surplus would be around 60 MMT, almost the same amount the country exported in 2023-24.

— Ukraine’s summer crops face heat, moisture stress. Ukraine’s summer crops may decline 20% to 30% in central, southern and eastern regions due to extreme heat, state weather forecasters said. The weather center said 30% to 50% of the overall area planted to summer crops could be affected by drought. Forecasters noted corn was at the most vulnerable stage of development to the effects of extreme temperatures and requires maximum moisture.

| POLICY UPDATE |

— Biden unveils rent cap plan. Biden is rolling out a proposal to dramatically limit rent growth nationwide, in the latest push by the White House to ease voter concerns about the skyrocketing cost of housing. The plan — which would revoke a depreciation tax credit for large landlords who increase rent by more than 5% in a year — would require legislative action and is unlikely to get support in the Republican-controlled House. “While the prior administration gave special tax breaks to corporate landlords, I’m working to lower housing costs for families,” Biden said in a statement. “Republicans in Congress should join Democrats to pass my plan to lower housing costs for Americans who need relief now.”

| CHINA UPDATE |

— U.S. tariffs at 60% would halve China’s growth rate: UBS. New research from UBS Group AG indicates that imposing a 60% tariff on all Chinese exports to the U.S. would significantly impact China’s economy, potentially more than halving its annual growth rate. If former President Donald Trump, who has considered such a tariff, returns to the White House, China’s GDP could be reduced by 2.5 percentage points in the year following the tariff’s implementation. Currently, Beijing aims for about 5% growth this year after achieving a 5.2% expansion in 2023. The forecast assumes some trade will be diverted through third countries, that China will not retaliate, and that no other nations will impose similar tariffs. The expected economic drag would be split between a decrease in exports and a reduction in consumption and investment.

Exports have been a significant growth driver for China this year, contributing 14% to the economy’s expansion and pushing the trade surplus to a record high last month. However, this export strength has led to complaints from trade partners, prompting more countries to impose or consider tariffs to counterbalance China’s trade practices. Over time, increasing exports through and production in other economies might mitigate the impact of higher US tariffs, but there is also the risk of other countries raising tariffs on Chinese imports.

Chinese retaliation could worsen the situation by increasing import costs. Even the risk and uncertainty of another trade war could deter U.S. importers, regardless of any future tariff reductions. UBS forecasts that China will grow by 4.6% next year and 4.2% in 2026, but this could drop to 3% for both years, even with stimulus measures. To counteract the effects of high tariffs, the Chinese government may use fiscal measures, ease monetary policy, issue special treasury bonds, and allow the currency to depreciate by 5% to 10%.

— China’s manufacturing outpaces economy for third straight quarter. China’s manufacturing sector grew faster than the overall economy for a third quarter in a row, underscoring how industry and exports are driving growth in the world’s second-largest economy, Bloomberg reports. Manufacturing expanded 6.2% last quarter, according to detailed GDP data released Tuesday. That was faster than the 4.7% real growth in the overall economy and kept the sector’s contribution to total activity at 27%, matching the previous quarter’s one-year high. This strength contrasts with the shrinking real estate sector, which contracted for a fifth quarter in a row.

| ENERGY & CLIMATE CHANGE |

— General Motors CEO Mary Barra has revised the company’s expectations for its electric vehicle (EV) program, particularly regarding the goal of selling one million EVs by 2025. Barra clarified that GM’s transition to a 100% electric fleet will unfold “over decades” rather than adhering to a specific short-term target. This represents a shift from the company’s previous, more aggressive timeline. The CEO emphasized that the pace of reaching the one million annual sales milestone for EVs will be determined by customer demand. This aligns with her statement that GM will be “customer-focused” as they go through this transformation. Despite the revised expectations, Barra maintains that GM is still committed to an all-electric future. The company continues to invest heavily in EV technology and infrastructure.

The adjustment in expectations comes amid softening EV sales in the U.S. market. In the first quarter of 2024, there was a quarter-over-quarter decline in EV sales and only a 3% year-on-year increase.

GM still aims to achieve “variable profits” for its EVs in the second half of 2024 and targets low- to single-digit pretax adjusted margin profits on EVs in 2025.

— Summit Carbon Solutions claims state and federal laws override Iowa counties’ pipeline ordinances. Summit Carbon Solutions argues that two Iowa county ordinances intended to limit the placement of carbon dioxide pipelines are overridden by state and federal regulatory authorities. This argument was reiterated in a recent brief to the federal court in response to appeals by Shelby and Story counties against a judge’s rulings that sided with Summit. An injunction currently prevents these counties from enforcing their ordinances. The case is now set for oral arguments before the Eighth Circuit U.S. Court of Appeals, with a decision expected next year.

Summit Carbon Solutions aims to build a 2,500-mile pipeline system across five states to transport captured carbon dioxide from ethanol producers to North Dakota for underground sequestration. The project, which received preliminary approval in Iowa last month, is driven by federal tax credits aimed at mitigating climate change. However, opponents are concerned about the safety risks posed by potential pipeline ruptures near populated areas and livestock.

The county ordinances establish minimum separation distances between pipelines and populated places. A federal judge ruled that the ordinances were overly restrictive, potentially preventing the construction of carbon dioxide pipelines. Other counties have adopted less restrictive ordinances, with the latest one approved by Dickinson County, which has not been sued by Summit.

Chief Judge Stephanie Rose of the federal Southern District of Iowa ruled that the placement requirements of the Shelby and Story ordinances are overridden by state and federal regulators, specifically the Iowa Utilities Commission and the Pipeline and Hazardous Materials Safety Administration (PHMSA). She also deemed that the placement requirements, being safety-related, fall under PHMSA’s jurisdiction. However, PHMSA has indicated that local governments traditionally regulate land use, including setback distances.

Summit argues that Judge Rose correctly identified the relationship between setbacks and safety, citing an early version of Story County’s ordinance focused on pipeline safety concerns. Summit contends that provisions requiring disclosure of information to local emergency officials fall under PHMSA’s jurisdiction. Furthermore, Summit asserts that the Iowa Utilities Commission has absolute authority to determine pipeline routes, rendering county ordinances irrelevant.

The American Petroleum Institute and the Liquid Energy Pipeline Association have filed briefs supporting Summit’s position, emphasizing the importance of pipelines to the U.S. economy and the exclusive authority of PHMSA over pipeline safety. They argue that the county ordinances could disrupt the nationwide system of pipeline safety standards.

The outcome of this court action will impact pending lawsuits against other counties, which have been paused until the Shelby and Story appeals are resolved. Meanwhile, PHMSA is updating its safety standards for carbon dioxide pipelines, with counties arguing that current rules are insufficient to protect the public and that there should be room for local control.

— New rules in the European Union now require all new cars to be equipped with the Intelligent Speed Assistance (ISA) system, which uses AI, GPS, sensors, and cameras to track and limit vehicle speed to ensure drivers do not exceed speed limits. However, the European Court of Auditors has expressed doubts about the effectiveness of these measures in reducing road deaths, citing weakened implementation and the infrequent replacement of cars by Europeans. Meanwhile, the United States has not implemented similar measures nationwide, although California recently passed a bill mandating passive speed limiters.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— The investigation into the human cases of bird flu (H5N1) in Colorado is ongoing, with federal and state authorities working together to assess the situation. Here are the key details:

• Confirmed cases: The Centers for Disease Control and Prevention (CDC) has confirmed four human cases of highly pathogenic avian influenza (HPAI) A(H5) virus infection in Colorado. A fifth presumptive positive case is pending confirmation.

• Affected individuals: All cases were in farm workers involved in the depopulation of poultry at a commercial egg layer operation experiencing an H5N1 outbreak.

• Symptoms: The workers reported mild symptoms, including conjunctivitis (pink eye), fever, chills, coughing, and sore throat/runny nose.

• CDC response: A multidisciplinary team of nine experts from the CDC has been deployed to Colorado to support the public health response. This team includes epidemiologists, veterinarians, clinicians, and an industrial hygienist.

• Ongoing monitoring: There is continued monitoring of workers, and additional specimens are being tested as part of the assessment.

• Risk assessment: The CDC currently believes that the risk to the public remains low. However, these cases underscore the potential risk of exposure to infected animals.

• Genetic sequencing: Attempts to sequence the virus from clinical specimens are underway at the CDC. This analysis will help determine if there are any genetic changes that could alter the agency’s risk assessment.

• Historical context: These are the first cases of H5 virus infection in poultry workers in the United States since 2022.

• Precautions: The CDC recommends avoiding close, long, or unprotected exposures to sick or dead animals, including wild birds, poultry, and other domesticated animals.

— Missouri Attorney General Andrew Bailey will intervene in an antitrust lawsuit against Tyson Foods, supporting poultry producers who claim that Tyson improperly sold a chicken processing plant in Dexter, southeastern Missouri, for conversion to an egg handling facility. The lawsuit, led by Grandview Farms on behalf of similarly situated chicken farms, alleges that Tyson Foods engaged in an “anticompetitive and fraudulent scheme to eliminate competition” when it closed its Dexter plant. The closure, which occurred in 2023, affected 683 employees and a broad network of chicken farmers who had contracts with Tyson.

The core of the complaint is that Tyson sold the Dexter plant to Cal-Maine Foods, a company that produces table eggs rather than processing broiler chickens. This move allegedly left many farmers who had built their operations specifically for chicken production “out in the cold,” as they were unable to continue their existing business relationships.

The lawsuit also claims that Tyson misled both U.S. Sen. Josh Hawley (R-Mo.) and Rep. Jason Smith (R-Mo.) about their intentions for the Dexter plant. Sen. Hawley had previously secured a commitment from Tyson’s CEO, Donnie King, pledging that Tyson would sell its Missouri plant to any interested party, including competitors, to support the more than 2,000 Missourians who lost their jobs.

Attorney General Bailey’s decision to intervene in the lawsuit demonstrates the state’s support for the affected poultry producers and its concern over potential anticompetitive practices in the industry. This move aligns with broader efforts to scrutinize and challenge potentially monopolistic behaviors in the meatpacking and poultry sectors, as evidenced by Senator Hawley’s introduction of the Strengthening Antitrust Enforcement for Meatpacking Act last September.

Bottom line: The case highlights the complex relationships between large food processing companies, local farmers, and state economies, as well as the potential impact of plant closures and sales on rural communities and agricultural supply chains.

| POLITICS & ELECTIONS |

— Judge dismisses documents case against Trump; Justice Dept. authorizes Special Counsel to appeal court’s order. A federal judge ruled that the case against Donald Trump involving secret documents should be dismissed due to the unconstitutional appointment of the special counsel, Jack Smith, who brought the charges. Judge Aileen Cannon, a Trump appointee, made this surprising decision, which contrasts with precedents set since Watergate. The case was seen as the most straightforward among the four criminal cases Trump faces.

Smith will appeal the decision to the 11th Circuit, per spokesperson Justice Department spokesman Peter Carr. Smith could try to refile in a different jurisdiction, with a different judge. Attorney General Merrick Garland can assign the investigation to another federal prosecutor.

If Trump wins the November election, he could request the Justice Department to drop the charges.

Background: Trump was accused of illegally retaining sensitive state secrets after leaving office and obstructing efforts to recover them.

— Elon Musk said he plans to commit around $45 million a month to a new pro-Trump super political-action committee. This significant financial commitment comes after Musk publicly endorsed Donald Trump following an assassination attempt on the former president during a campaign event. America PAC was established in late May 2024 with the primary goal of supporting Trump’s political endeavors. The super PAC has already attracted donations from several prominent business figures.

— Highlights from President Biden’s interview with NBC’s Lester Holt:

• Biden described his phone call with Donald Trump after the assassination attempt as “very cordial.” He expressed concern for Trump’s well-being and said he and Jill were praying for Trump and his family.

• Regarding the assassination attempt, Biden strongly condemned political violence, stating there is “no place at all for violence in politics in America, none, zero.”

• Biden acknowledged making a mistake in using the term “bullseye” when referring to Trump during a donor call. He clarified that his intention was to focus on Trump’s actions and policies, not to incite negativity.

• When asked about his age and calls from some Democrats to step aside, Biden defended his decision to stay in the race. He emphasized his mental acuity, stating “my mental acuity’s been pretty damn good” and pointing to his accomplishments as president. Biden said he’s holding to his decision to remain in the race, reiterating his performance at last month’s debate was just a bad night.

• Biden pushed back on media coverage of the campaign, challenging Holt on the focus of reporting and questioning why there wasn’t more coverage of Trump’s alleged falsehoods.

• Regarding Trump’s choice of J.D. Vance as a running mate, Biden expressed no surprise, highlighting Vance’s alignment with Trump on issues like abortion, tax cuts, and climate change.

• Throughout the interview, Biden adopted a defensive stance, particularly when addressing questions about his debate performance and mental fitness. He asserted that he doesn’t need notes or teleprompters and can answer any questions.

| OTHER ITEMS OF NOTE |

— Secret Service Director Kim Cheatle addresses Saturday’s shooting, calls incident unacceptable; President Biden orders independent review of agency protocols. In her first network interview since Saturday’s shooting, Secret Service Director Kim Cheatle spoke to ABC News yesterday, saying this was an incident that should have never happened. “What I would say is the Secret Service is responsible for the protection of the former president.” Cheatle said. “The buck stops with me. I am the director of the Secret Service. It was unacceptable and it’s something that shouldn’t happen again.”

President Biden has ordered an “independent review” of the agency’s protocol, though Cheatle said she plans to make immediate changes.

In an interview with NBC News, also on Monday, Biden was asked his thoughts on the Secret Service. “Do you have confidence in the Secret Service? Do you feel safe?” Nightly News anchor Lester Holt asked. “I feel safe with the Secret Service,” Biden assured him. “But look, you saw the — what we did see was the Secret Service who responded risked their lives responding. They were ready to give their lives for the president. The question is: should they have anticipated what happened? Should they have done what they needed to do to prevent this from happening? That’s the question that’s — that’s an open question.”

— EPA announced new protections against pesticide spray drift, expanding its assessment of potential human exposure to pesticides that drift away from their intended application sites. Key points:

• Earlier assessment: EPA will now evaluate the potential for human exposure to pesticide drift earlier in the agency’s review process.

• Expanded scope: This assessment will now apply to new active ingredients, new uses, and amended uses of pesticides, not just during periodic reviews.

• Immediate effect: The new policy took effect immediately upon announcement.

• Modeling tools: EPA uses peer-reviewed spray drift models (AgDRIFT and AGDISP) to estimate the contribution of spray drift to both ecological and human health risks.

• Comprehensive approach: This change aims to provide more comprehensive protection for people living near agricultural areas where pesticides are applied.

• Addressing long-standing concerns: The move addresses concerns about the potential health impacts of pesticide drift on nearby communities, as illustrated by the 2004 incident near Lamont, California.

• Best Management Practices: While EPA is increasing protections, it’s worth noting that in the past, the agency has avoided putting Best Management Practices (BMPs) for spray drift prevention directly on pesticide labels due to their complexity and variability.

— Lawsuit challenges U.S. over conservation leases on public land. The lawsuit filed by various industry groups against the Interior Department’s new rule on conservation leases for public lands highlights a significant legal challenge to the Biden administration’s environmental policies. The lawsuit argues that the new rule is “flatly inconsistent” with federal land management laws. This claim is rooted in the interpretation of the Bureau of Land Management’s (BLM) mandate for “multiple use” of public lands.

The legal action comes shortly after a Supreme Court decision in June that reduced the leeway given to federal agencies in interpreting laws. This timing is significant as it may impact how the courts view the Interior Department’s authority to implement such rules.

The Interior Department’s rule aims to elevate conservation to an equal status with other uses of public lands, such as oil drilling, grazing, and mining. It introduces “restoration leases” and “mitigation leases” for conservation purposes.

The lawsuit was filed by a coalition of 12 groups representing farming, petroleum, mining, electric power, and timber industries. These groups argue that the rule could potentially limit their access to and use of public lands.

The Biden administration and Interior Secretary Deb Haaland assert that the rule is designed to “restore balance” in public land management and address climate change impacts. They argue that it doesn’t prioritize conservation over other uses but rather places it on equal footing.

This legal challenge could have significant implications for the Biden administration’s broader environmental and climate policies, particularly those involving public land management. The lawsuit is part of a larger debate about the balance between conservation and resource extraction on public lands, which has been a contentious issue in U.S. environmental policy for decades.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |