News/Markets/Policy Updates: Dec. 18, 2024

— Farm groups and farm-state lawmakers had to first sell Congress on the need for substantial aid via CR (link to text), now congressional leaders must sell others to pass it. The ag sector portion in the continuing resolution (CR) through March 14 echoes what we informed Tuesday morning. Highlights: · Stop-gap spending through March 14 for fiscal year 2025 that began Oct. 1. Bottom line: The disaster crop loss program will likely operate similarly to the 20-21 program without any of the 2022 quirks that made it into a debacle. The livestock program will likely operate similar to the 2022 livestock program where the Biden administration actually managed to get it right. The economic aid program is very similar to Kelly farm act with a factor applied to keep it within budget. The coming votes: House Speaker Mike Johnson (R-La.) is expected to turn to Democrats to supply the bulk of votes needed to get the bill to the Senate. It appears lawmakers would have at least a day to review the package. It looks like Johnson will bring the CR up under suspension of the rules, which requires a two-thirds majority for passage. A floor vote has yet to be scheduled, but the initial assessment is that the House will take it up as early as Thursday or more likely on Friday. That leaves the Senate little time to clear the measure before Friday’s midnight deadline. But even if the final action does not occur Friday, there is wiggle room on the weekend to get it done. Democrats celebrated inclusion of priorities like funding for childcare and 9/11 survivors’ health care benefits; restrictions on China-related investments; legislation intended to crack down on publication of artificial intelligence-generated “deepfakes,” and on “junk” fees charged for hotel stays and concert tickets; new safety standards for lithium-ion batteries; and more. Taxpayers would recoup some of the bridge rebuilding cost through proceeds from insurance and litigation payouts by the owner of the cargo ship Dali, which crashed into the bridge in March. Also included: $25.6 million for residential security and protection of Supreme Court justices. Negotiators also agreed to a 100% federal cost-share for Francis Scott Key Bridge reconstruction in Baltimore, a key demand of the Maryland delegation — who elsewhere in the bill had to accept language paving the way for a new Washington Commanders stadium on the old Robert F. Kennedy Memorial Stadium, while transferring a D.C. National Guard fighter squadron to Maryland. Appropriators threw in an unrequested $300 million for fisheries disaster aid, which Sen. Lisa Murkowski (R-Alaska) and others sought. The deal omits language that Democrats were seeking to unfreeze $20 billion in IRS enforcement funding. — CR package includes nationwide year-round sales of 15% ethanol gasoline (E15) and offers short-term biofuel blending relief to small refiners. Previously, E15 was restricted during summer months, though eight Midwestern states had already been granted year-round sales earlier this year. The inclusion of the E15 language, based on a bill by Sen. Deb Fischer (R-Neb.), marks a major win for ethanol producers and farm state lawmakers who have spent years lobbying to permanently allow year-round E15 sales. The bill would also provide short-term relief to some small refiners under the Renewable Fuel Standard (RFS) that retired renewable identification numbers (RINs) in 2016-18 in cases when their requests for “hardship” waivers remained pending for years. The bill would return some of those RINs to the small refiners and make them eligible for compliance in future years. Enacting the stopgap funding bill would also make it unnecessary for eight states to follow through with a costly gasoline blendstock reformulation — set to begin as early as next summer — they had requested to retain year-round E15 sales in the midcontinent. Oil industry groups last month petitioned EPA to delay the fuel reformulation until after the 2025 summer driving season, citing concerns about inadequate fuel supply and the prospects that a legislative fix would make required infrastructure changes unnecessary. Ethanol groups say the E15 legislative change could pave the way for retailers to more widely offer the high-ethanol fuel blend, which is currently available at 3,400 retail stations and last summer was about 10-30¢/USG cheaper than 10% ethanol gasoline (E10). Offering the fuel year-round would be “an early Christmas present to American drivers,” ethanol industry group Growth Energy chief executive Emily Skor said. Monte Shaw, executive director of the Iowa Renewable Fuels Association, said biofuels “champions” are fighting for the provision allowing the sale of E15 year-around. “We have been working to get a year-round E15 solution for over 10 years,” he said in a statement. “It would be monumental for ethanol demand to support rural farmers and would save drivers 10 to 20 cents at the pump.” The potential increase in ethanol consumption and corn use due to year-round E15 sales is relatively modest based on the available information. The additional ethanol consumption from year-round E15 sales is estimated to be approximately 15 million gallons. This represents a small fraction of the total U.S. ethanol production. The 15-million-gallon increase in ethanol consumption would translate to an additional corn use of about 5.6 million bushels. It’s important to note that the impact of year-round E15 sales is limited by several factors:

Looking ahead, maintaining current corn use levels for ethanol (around 5.5 billion bushels) would require increasing the national average ethanol blend rate to 15-17% by 2042, given projected declines in gasoline consumption. This suggests that year-round E15 sales alone may not be sufficient to significantly boost corn use for ethanol in the long term. However, others note the quickest way to get consumer attention is with price and E15 is the cheapest option for most cars… in many markets it’s cheap enough that consumers seek it out. Also, some think it’s not even a question for new facilities to include E15 … it’s the easiest way to be competitive in a market. Either way, year-round E15 sales represent a symbolic victory for corn ethanol advocates, the immediate impact on ethanol consumption and corn use is expected to be minimal in the short run, but differences of opinion are in place regarding long-term impacts. A bewildering assessment of the year-round E15 impact came from some traders, based on a Reuters article. The concern expressed by traders regards a potential shift in demand from biodiesel to ethanol due to year-round E15 sales. That is a questionable conclusion. Consider:

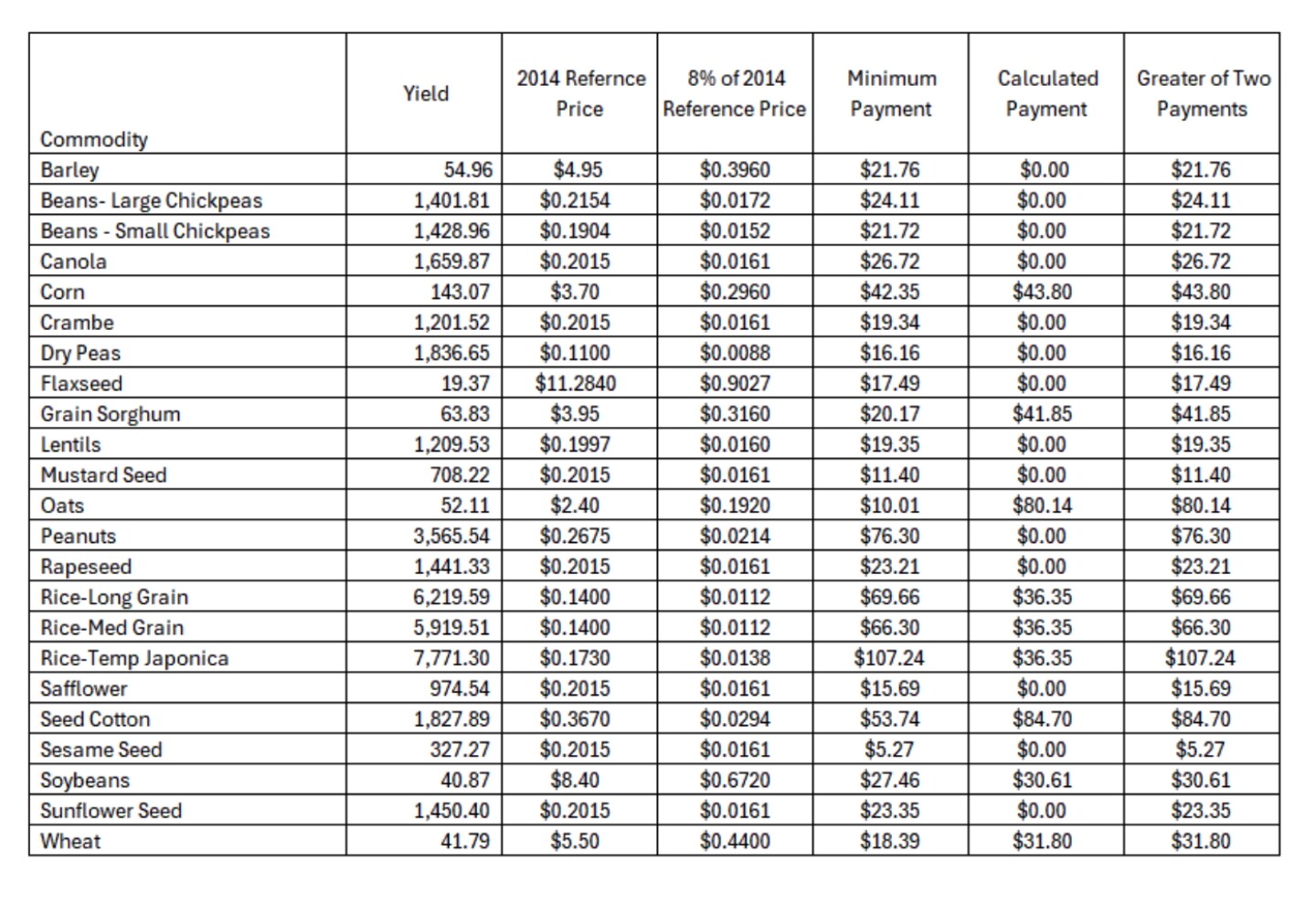

— Paul Neiffer’s analysis of the $10 billion in financial aid included in the CR. Here are the key details and the differences from the original FARM Act: The same 8 crops are specifically identified (corn, wheat, soybeans, cotton, rice, peanuts, oats and barley). You will be paid on total 2024 planted acres by crop plus 50% of prevent planted acres by crop. You will receive a payment based on the GREATER of: · The Sum of: Here is an updated table of Neiffer’s estimated per acre payment amounts based on his knowledge of the provisions: — Trump takes legal action against media over polls and reporting. Donald Trump has sued the Des Moines Register and pollster Ann Selzer for publishing pre-election forecasts showing him trailing Kamala Harris in Iowa. The polls, released on Nov. 2 — three days before the vote — were labeled by Trump as “brazen election interference.” Despite the projections, he ultimately won the state by 13 points. This lawsuit is part of a broader effort by Trump to challenge critical media coverage, following his recent $15 million defamation victory against ABC News. — Canada bolsters border security amid U.S. pressure. Canada unveiled a C$1.3 billion ($900 million) plan to enhance border security following meetings with Tom Homan, tasked with leading former President Trump’s crackdown on illegal immigration. Dominic LeBlanc, Canada’s finance and public-safety minister, announced funding to hire additional border officers and deploy dogs, helicopters, and drones. The move follows Trump’s warning of 25% tariffs on Canadian imports unless stricter measures are taken against migration and drug smuggling — tariffs that could push Canada into a recession. |

| MARKET FOCUS |

— Equities today: Asian and European stock indexes were mixed to firmer overnight. U.S. stock indexes are pointed toward firmer openings. In Asia, Japan -0.7%. Hong Kong +0.8%. China +0.6%. India -0.6%. In Europe, at midday, London +0.2%. Paris +0.3%. Frankfurt +0.4%.

U.S. equities yesterday: All three major indices ended lower, with the Dow down 267.58 points, 0.61%, at 43,449.90. The Nasdaq lost 64.83 points, 0.32%, at 39,364.68. The S&P 500 declined 23.47 points, 0.39%, at 6,050.61.

— Honda and Nissan: Potential merger to reshape Japan’s auto industry. Honda and Nissan, Japan’s second and third-largest automakers, are in early discussions about a potential merger, a move that could transform the Japanese automotive sector. With mounting global competition, especially in the electric vehicle (EV) market, the companies aim to consolidate resources and strengthen their market position. Preliminary talks involve signing a memorandum of understanding for shared equity stakes in a new holding company under which the merged entity would operate. Mitsubishi Motors may also join the merger. Honda and Nissan have been collaborating on EV batteries and software since early 2024. Mitsubishi joined this effort in August. Together, Honda, Nissan, and Mitsubishi sold 3.7 million vehicles in the first half of 2024, compared to Toyota’s 4.5 million. The merger could streamline Japan’s auto industry into two primary groups: the Honda-Nissan-Mitsubishi alliance and the Toyota group.

— Ag markets today: Soybeans plunged to contract lows overnight amid heavy pressure from soyoil, while corn and wheat traded mildly higher. As of 7:30 a.m. ET, corn futures were trading mostly a penny higher, soybeans were 9 to 11 cents lower and wheat futures were 2 to 4 cents higher. The U.S. dollar index was trading just below unchanged, and front-month crude oil futures were around 50 cents higher.

After three days of price gains, wholesale beef values weakened on Tuesday with Choice down $1.74 to $315.63 and Select $1.07 lower to $288.50. Despite the lower prices, movement slowed to 112 loads, signaling retailers have completed purchases for holiday features.

The CME lean hog index is up 14 cents to $83.98 as of Dec. 16. The index is only 65 cents off its recent low but has risen in three of the last five days, hinting that a seasonal bottom may be in the works.

— Agriculture markets yesterday:

• Corn: March corn futures fell 1 1/2 cents to $4.43 1/2, near mid-range.

• Soy complex: January soybeans fell 5 1/4 cents to $9.76 3/4, marking the lowest close since Aug. 16, while January soymeal rose 30 cents to $287.20 after marking a contract low in early trade. January soyoil fell 110 points to 40.62 cents, the lowest close since Sept. 18.

• Wheat: March SRW futures fell a nickel to $5.45 and settled nearer session lows. March HRW futures sunk 6 3/4 cents to $5.52 1/2. March HRS futures fell a nickel to $5.95.

• Cotton: March cotton fell 37 points to 68.69 cents, marking the lowest close since Aug. 14.

• Cattle: February live cattle futures fell 22.5 cents to $189.75 while nearby December futures climbed 22.5 cents to $192.25. January feeder cattle futures surged $1.925 to $257.475 and settled nearer session highs.

• Hogs: February lean hogs fell 35 cents to $83.20, nearer the daily low and closed at a four-week-low close.

— Fed meeting results, forecasts, presser today. The Federal Open Market Committee (FOMC) concludes its two-day meeting today, with a widely anticipated 25-basis-point cut to the Fed funds rate target range. Attention will shift to the updated economic and policy forecasts, particularly the outlook for the Fed funds rate through 2025. Markets expect two rate cuts in 2025, and any divergence in Fed officials’ projections could significantly influence sentiment. Fed Chair Jerome Powell’s 2:30 p.m. ET press conference will further shape market reactions. While questions about potential Trump-era policies are expected, Powell is likely to maintain his stance that it is “too early” to assess their economic impacts. His comments and the forecasts will be pivotal as the year transitions into 2025.

— New FOMC members in 2025: More hawkish or dovish? Based on the projected composition of the Federal Open Market Committee (FOMC) for 2025, there is a slight shift towards a more hawkish stance, but the overall balance remains nuanced.

Hawkish Influences. Several incoming FOMC voters for 2025 are considered to lean hawkish:

- Beth Hammack (Cleveland Fed): While new to her role, she’s expected to maintain the traditionally hawkish stance of the Cleveland Fed.

- Alberto Musalem (St. Louis Fed): Viewed as more hawkish than his predecessor.

- Jeff Schmid (Kansas City Fed): Likely to continue the Kansas City Fed’s historically hawkish position.

- Susan Collins (Boston Fed): Generally considered to have a slightly hawkish lean.

Among the permanent voting members, Governors Michelle Bowman and Christopher Waller are known for their hawkish views.

Dovish counterbalance. There are also dovish elements to consider:

- Austan Goolsbee (Chicago Fed): Known for his more dovish stance.

- Governors Lisa Cook, Michael Barr, and Adriana Kugler are generally seen as doves.

Centrist influence. Several key members occupy a more centrist position:

- Jerome Powell (Fed Chair): While sometimes viewed as slightly hawkish, he tends to steer a middle course.

- John Williams (New York Fed): Generally considered a centrist.

- Philip Jefferson (Fed Governor): Viewed as neutral.

Overall outlook: While the 2025 FOMC composition does include some notably hawkish additions, the presence of dovish governors who vote at every meeting provides a counterbalance. The slight hawkish tilt is likely to be moderated by these permanent dovish voters and centrist influences. Individual stances can evolve based on economic conditions. The FOMC’s decisions are ultimately driven by data and economic developments rather than predetermined ideological positions. As such, while the 2025 FOMC may lean slightly more hawkish, policy decisions will continue to be made based on the evolving economic landscape and the Fed’s dual mandate of price stability and maximum employment.

— Iowa farmland values decline after five-year streak. Farmland prices in Iowa experienced a 3.1% drop in 2024, ending a five-year streak of annual increases, according to the Iowa State University Land Value Survey. The statewide average value of farmland fell to $11,467 per acre, marking a $369 decrease from last year. Inflation-adjusted values dropped further, down 5.5% to $8,627 per acre.

- High-quality land: Down 2.6% to $13,930 per acre.

- Medium-quality land: Down 3% to $10,740 per acre.

- Low-quality land: Down 2.8% to $7,450 per acre.

Notably, eight of the nine crop reporting districts saw declines, with the west-central district leading the drop at 7.4%. However, the south-central district bucked the trend with a 3.6% increase. Despite this year’s decline, average values remain higher than the peak reached in 2022.

Market perspectives:

— Outside markets: The U.S. dollar index was near steady. Nymex crude oil futures prices are modestly up and trading around $70.50 a barrel. The yield on the benchmark 10-year U.S. Treasury note is presently 4.401%.

— Panic hits Brazilian markets. First it was a collapse in the real, which fell to a record low against the U.S. dollar. Now the rest of Brazil’s financial markets are in the crosshairs as investors lose faith in the government’s ability to contain a deepening fiscal crisis, as deficit concerns outweigh economic growth. Market watchers say extraordinary measures on Tuesday by the central bank to stem the currency’s slide are little more than a temporary fix and warn that lawmakers’ moves to water down a high-profile austerity package are likely to only add to the turmoil.

— Ag trade update: Japan purchased 4,000 MT of feed wheat. Tunisia tendered to buy 100,000 MT of soft milling wheat and 100,000 MT of durum wheat — all optional origin.

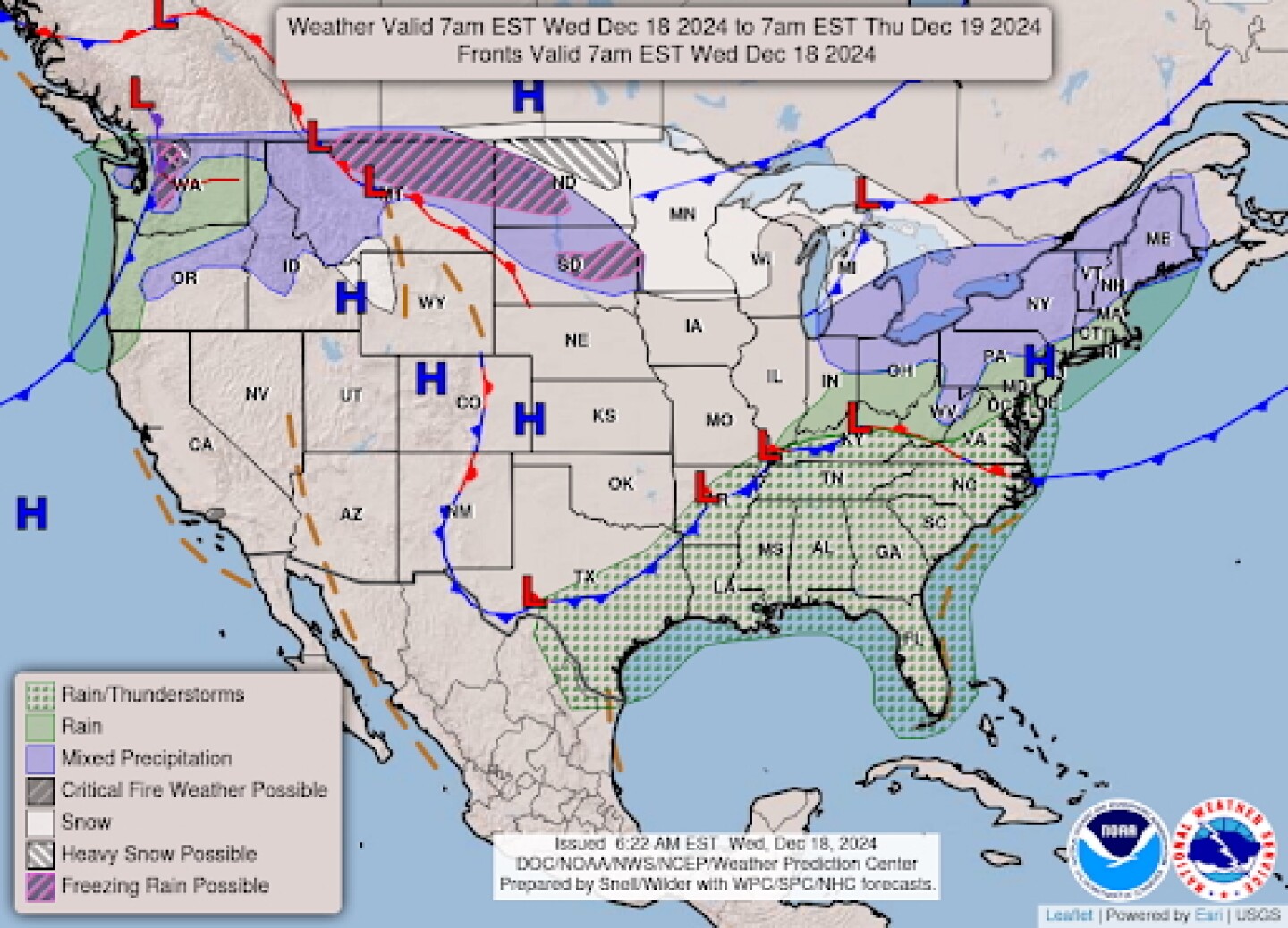

— NWS outlook: Clipper system to bring periods of moderate to heavy snow and gusty winds to the northern Plains and Upper Midwest/Great Lakes the next couple of days...

...Showers and storms continue into the day Wednesday for the Ohio/Tennessee Valleys with some locally heavy rainfall and isolated flash flooding possible... ...Well above average temperatures continue for much of the lower 48.

Items in Pro Farmer’s First Thing Today include:

· Beans, soyoil face active followthrough selling overnight

· Wholesale beef rally halted

· Cash hog index hinting at seasonal low

· France cuts wheat export forecast

· Euro zone consumer inflation rises less than initially estimated in November

| CONGRESS |

— The House Ag Committee released the Republican roster for 119th Congress, which includes six new members: Reps. Dan Newhouse of Washington and Tony Wied of Wisconsin, and Reps.-elect Rob Bresnahan of Pennsylvania, Mark Harris of North Carolina, Mark Messmer of Indiana and David Taylor of Ohio.

— Connolly secures top oversight role over Ocasio-Cortez in key Democratic vote. Gerry Connolly, a 74-year-old centrist, has been elected as the top Democrat on the House Oversight Committee, defeating Alexandria Ocasio-Cortez, a 35-year-old progressive challenger. The committee, tasked with overseeing the incoming Trump administration, will play a crucial investigative role. Ocasio-Cortez’s bid reflected growing efforts by younger Democrats to challenge the party’s senior leadership. However, Connolly’s seniority and strong support among centrist colleagues and former speaker Nancy Pelosi (D-Calif.) ultimately secured his victory.

| CHINA UPDATE |

— Sinograin halts imported Corn auctions to support domestic prices. China’s Sinograin announced it will stop auctioning imported corn from its inventories in an effort to boost domestic corn prices, which have dropped to their lowest level in four-and-a-half years. The state stockpiler previously committed to increasing purchases and storage of domestically produced corn. However, the impact of this decision may be limited, as auction volumes of imported corn are relatively small. Additionally, China has significantly reduced corn imports, with November imports down 91.8% year-on-year. From January to November, total corn imports fell 39.9% to 13.32 million metric tons (MMT).

— China’s pork imports double in November but still below year-ago. China imported 180,000 MT of pork in November, double the amount it brought in during the previous month but still 3.4% less than last year. Through the first 11 months of this year, China imported 2.09 MMT of pork, down 17.4% from the same period last year.

— China to promote modernization of farms in pledge to ensure food security. China will accelerate the pace of agricultural and rural modernization and stabilize planted area in its quest to ensure stable and high grain production, state-run Xinhua news reported. At an annual meeting that sets rural policy priorities for the year ahead, policymakers highlighted a need to improve farmers’ incomes and strengthen the use of agriculture science, technology and equipment. “We must resolutely shoulder the important task of ensuring national food security... stabilize the grain planting area, deepen the action of increasing the yield of grain and oil crops on a large scale,” Xinhua reported. Policymakers said China will also improve the policy system for supporting grain production and improve the protection and quality of cultivated land.

— Canada to impose more tariffs on Chinese imports. Canada plans to impose tariffs on a slew of Chinese products from as soon as early in the new year, the government’s fiscal update showed, as part of its wider investigation into imports from the country. Prime Minister Justin Trudeau’s government has already slapped a 100% tariff on all Chinese electric vehicles and a 25% tariff on imports of Chinese steel and aluminum products. The mid-year fiscal update presented on Monday showed that Ottawa has decided to apply tariffs to imports of certain solar products and critical minerals from China early in the new year, with levies on semiconductors, permanent magnets and natural graphite following in 2026. The Fall Economic Statement did not detail the extent of the duties to be imposed, nor on which specific products, but said further details on the measures would be announced soon.

— China pushes back against bond buying spree. China’s central bank sent its first signal in months of its discomfort with the record-setting bond rally that drove yields to record lows. The People’s Bank of China (PBOC) has urged financial institutions involved in “aggressive trading” in the bond market to pay close attention to relevant risks including those in the rates market, PBOC-backed Financial News reported, citing unidentified people. Investors had been piling into Chinese government bonds on bets rising risk of a trade war with the U.S. will prompt top leaders to roll out bolder monetary stimulus to support the economy next year. Plunging Chinese yields stoked concern the country is heading into a Japanese-style balance sheet recession. The widening China/U.S. yield differential also weighed heavily on the yuan.

| TRADE POLICY |

— Trump and Argentina’s Milei: A new free-market alliance? “The United States discovered that we’re a trustworthy partner,” Argentine President Javier Milei told the Wall Street Journal (link). Milei, coming off a surprising first year marked by sharp economic reforms, sees U.S. President-elect Donald Trump as a key ally in Argentina’s free-market transformation.

Milei has slashed government spending, cut public jobs, and tamed inflation, which fell from nearly 26% to 2.4% monthly since he took office. Despite fears of unrest, he maintains a robust 55% approval rating, with wages, exports, and investor confidence rising.

Milei expects Trump to back Argentina’s push for fresh IMF financing and explore a U.S./Argentina trade deal, although Trump has yet to offer public support. The two leaders plan further discussions at Trump’s inauguration in January.

As Milei seeks to deepen ties with Washington, he has softened his stance on China, calling relations “excellent.” While Milei remains steadfast in his anarcho-capitalist principles, his reforms aim to balance the budget and restore Argentina’s place in global markets by 2026.

“I’m not going to stop,” Milei said, vowing to make Argentina “the freest country in the world.”

| ENERGY & CLIMATE CHANGE |

— Biden report on LNG exports sparks policy debate for incoming Trump administration. The Biden administration’s recent report on liquefied natural gas (LNG) exports has ignited controversy, framing key challenges for the incoming Trump administration’s energy policies.

Department of Energy report findings:

- Economic Impact: Unchecked LNG exports could raise domestic natural gas prices by over 30%, costing households an extra $100 annually by 2050.

- Environmental concerns: Expanded exports risk increased greenhouse gas emissions and pollution in coastal areas near export terminals.

- National security: The report cautions that higher exports may inadvertently benefit China with access to cheaper fuel.

The U.S. became the world’s largest LNG exporter in 2023, shipping 88.9 million metric tons. Current export capacity is 14 billion cubic feet per day (bcfd), with plans authorized for a potential increase to 48 bcfd.

The Biden administration paused pending LNG export permits in January 2024, citing sustainability concerns. Energy Secretary Jennifer Granholm stressed the need for a reassessment.

President-elect Trump plans to reverse Biden’s pause and expand LNG exports, despite warnings in the DOE report.

The American Gas Association criticized Biden’s moratorium as a misstep.

Environmental advocacy groups intend to use the DOE’s findings to challenge Trump administration approvals of new LNG projects.

| LIVESTOCK, NUTRITION & FOOD INDUSTRY |

— USDA imposes restrictions on animal commodities from El Salvador amid New World Screwworm threat. On Dec. 10, USDA’s Animal and Plant Health Inspection Service (APHIS) enacted strict restrictions on animal commodities from El Salvador after detecting New World screwworm (NWS) in cattle. This measure aims to safeguard U.S. livestock and wildlife from the significant threat posed by NWS infestation. Restrictions apply to animal commodities from or transiting through El Salvador. Prohibited Items: Live ruminants, swine, and their germplasm.

Background. NWS detections in Central America and southern Mexico in late 2024 heightened concerns about the pest’s spread. NWS, a serious threat to livestock and wildlife, causes painful infestations with severe economic implications. The U.S. livestock industry benefits significantly from past eradication efforts, saving approximately $900 million annually.

— USDA expands efforts to combat Listeria in food processing. USDA’s Food Safety and Inspection Service (FSIS) unveiled new initiatives to tackle Listeria contamination in food products. Key actions include expanding Listeria testing starting in 2025 for ready-to-eat products, environmental samples, and food contact surfaces, while improving sanitation oversight. FSIS will enhance training for inspectors, update guidelines, and strengthen state inspection agreements. A priority will be Food Safety Assessments at ready-to-eat meat and poultry facilities that rely solely on sanitation measures. Weekly inspections will address Listeria-related risks, with further actions depending on funding availability. These measures aim to bolster public safety through a science-driven approach.

— Gene-edited pig kidney transplanted into third patient, advancing xenotransplantation. A 53-year-old woman, Towana Looney, became the third recipient of a genetically modified pig kidney, marking a milestone in xenotransplantation. Looney, who previously donated a kidney to her mother, faced near-impossible odds of finding a human organ due to high antibody levels. The surgery, conducted at NYU Langone Health, allowed her to avoid dialysis for the first time in eight years. The kidney, provided by Revivicor, included 10 genetic edits to reduce immune rejection. Doctors see Looney’s case as key to understanding long-term outcomes before clinical trials, offering hope for addressing the critical U.S. organ shortage.

| KEY LINKS |

WASDE | Crop Production | USDA weekly reports | Crop Progress | Food prices | Farm income | Export Sales weekly | ERP dashboard | California phase-out of gas-powered vehicles | RFS | IRA: Biofuels | IRA: Ag | | Russia/Ukraine war, lessons learned | | SCOTUS on WOTUS | SCOTUS on Prop 12 pork | New farm bill primer | | Gov’t payments to farmers by program | Farmer working capital | USDA Ag Outlook Forum |