The U.S. Economic Policy Uncertainty Index is a widely used metric developed by Scott R. Baker, Nick Bloom, and Steven J. Davis to quantify economic uncertainty related to policy decisions. It combines three main components:

- Newspaper coverage: This involves tracking the volume of articles from major U.S. newspapers (such as the New York Times and Wall Street Journal) that discuss economic policy uncertainty.

- Federal tax code expirations: This component measures the number of federal tax provisions set to expire, as reported by the Congressional Budget Office (CBO), indicating uncertainty about future tax policies.

- Forecast disagreement: It assesses the dispersion in predictions among economic forecasters regarding key variables like the Consumer Price Index (CPI) and government expenditures, reflecting uncertainty about future policy impacts.

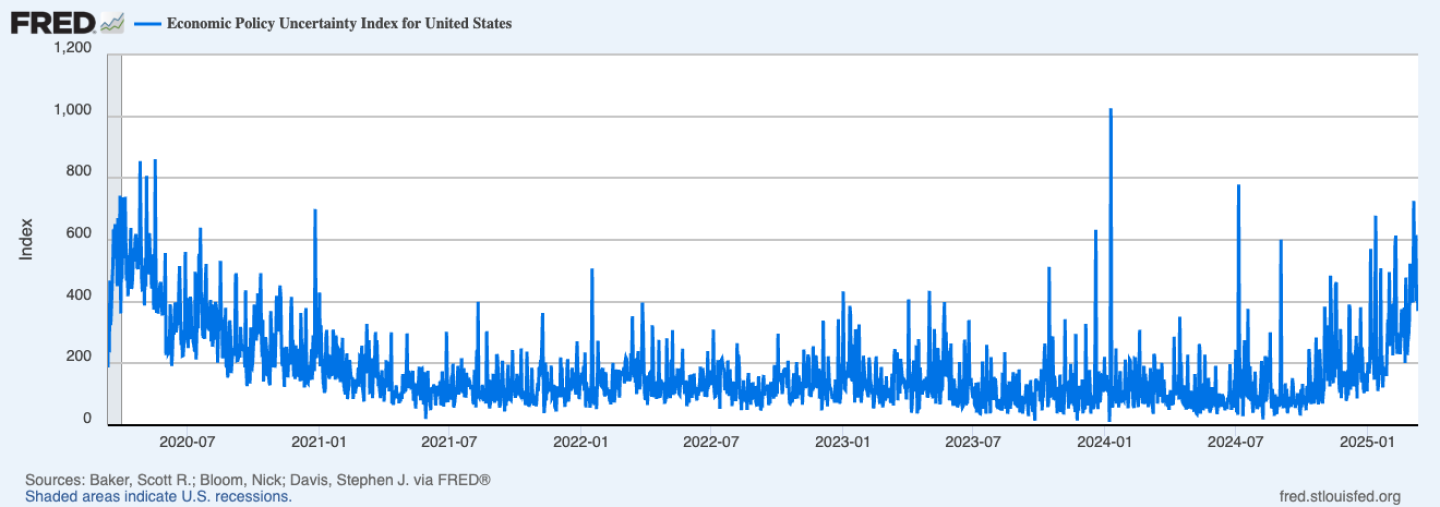

As of March 12, the U.S. Economic Policy Uncertainty Index stood at 369.42, which is significantly lower than its record high of 1026.38 in January 2024 but still reflects heightened uncertainty compared to historical averages. This elevated level of uncertainty is attributed to factors such as policy changes, trade tariff fluctuations and concerns about government shutdowns.

The index has historically spiked during periods of significant policy changes or crises, such as the Great Recession and the Covid-19 pandemic. High levels of policy uncertainty can lead to reduced economic activity as businesses and consumers delay major decisions due to increased risk perceptions.

Economic policy uncertainty can significantly impact financial markets and economic growth. It often leads to increased volatility in equity markets, as seen in the Russell 1000 index, particularly during election cycles. While higher uncertainty does not necessarily lead to sustained market volatility, it can cause short-term spikes.

The elevated index value indicates increased economic risks, as businesses and consumers may delay decisions due to policy ambiguity. This rise coincides with other worrying economic indicators, such as declining consumer sentiment and increased market volatility.